Transformation of Structural Economics Continues at Pace

Operating and Gross Margin Both Improve Year-over-Year

Provides Preliminary Outlook for Full Year 2025

ATLANTA--(BUSINESS WIRE)--Feb. 7, 2025-- Newell Brands (NASDAQ: NWL) today announced its fourth quarter and full year 2024 financial results.

Chris Peterson, Newell Brands President, and Chief Executive Officer, said, "Newell Brands delivered strong results in 2024 driven by disciplined implementation of our new corporate strategy, operating model and culture transformation. We drove year-over-year sales performance improvement as we significantly strengthened the company’s front-end selling and marketing capabilities. The Learning and Development segment returned to positive annual sales growth despite category declines. We drove strong gross and operating margin improvement, while purposely increasing our level of A&P investment, and we meaningfully de-levered the balance sheet through both debt reduction and EBITDA growth. While much work remains and the macroeconomic backdrop is still uncertain, we are laser-focused on returning the company to sustainable topline growth, continuing to drive operating margin improvement ahead of our evergreen target and strengthening the balance sheet."

Mark Erceg, Newell Brands Chief Financial Officer, said, "During the fourth quarter we successfully refinanced $1.25 billion of debt at attractive rates as part of an offering which was six times oversubscribed. We believe the strong support our offering received reflects the considerable work done since the adoption of our new corporate strategy six quarters ago which has improved Newell’s top-line performance, strengthened our balance sheet and, most importantly, fundamentally transformed our structural economics. Fourth quarter reported gross margin increased by 430 basis points to 34.2% compared to the same quarter last year and was 790 basis points higher than the fourth quarter of 2022. The fact that we have driven such rapid and pronounced gross margin expansion during a period of top line compression and a sustained and sizable draw down in inventory levels, both of which drove our plant networks capacity utilization levels down, is particularly notable. Looking forward, Newell Brands' core sales growth is expected to positively inflect during the back half of 2025 and, when that occurs, we believe the work done to create operational scale and efficiency across our plant and distribution system will be even more apparent."

Fourth Quarter 2024 Executive Summary

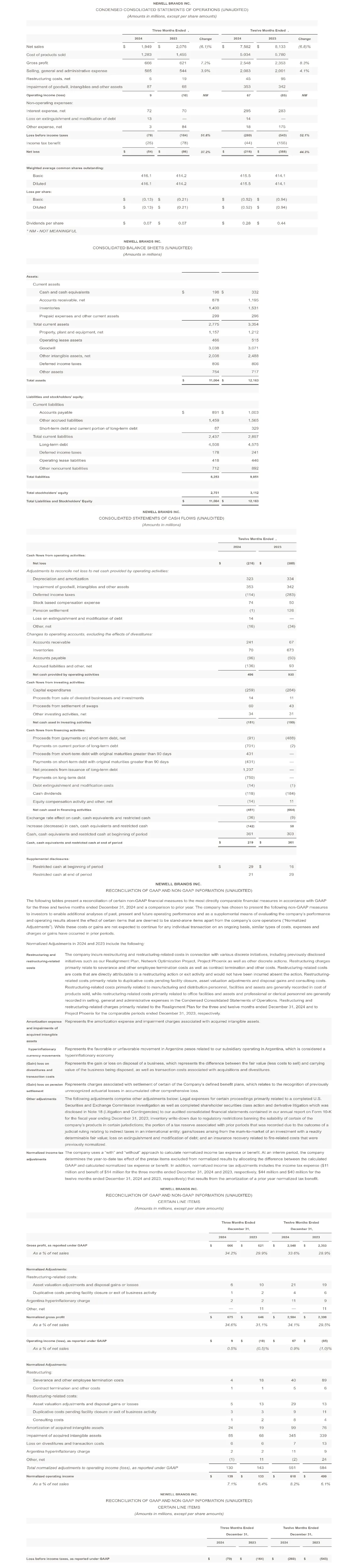

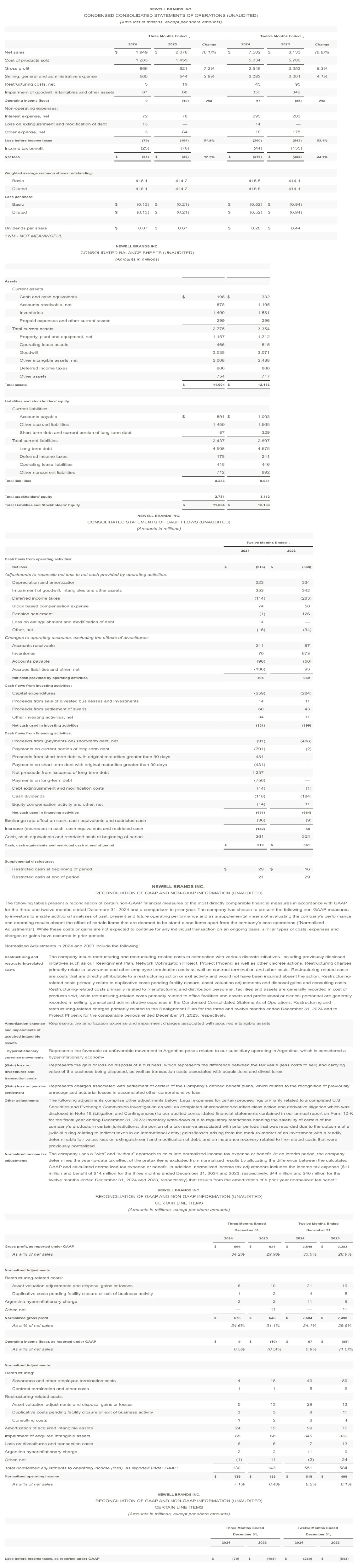

Net sales were $1.9 billion, a decline of 6.1% compared with the prior year period. Core sales declined 3.0% compared with the prior year period.

Reported gross margin increased to 34.2% compared with 29.9% in the prior year period. Normalized gross margin increased to 34.6% compared with 31.1% in the prior year period.

Reported operating margin improved to 0.5% compared with negative 0.5% in the prior year period. Normalized operating margin increased to 7.1% compared with 6.4% in the prior year period.

Reported net loss was $54 million compared with $86 million in the prior year period. Normalized net income was $69 million compared with $73 million in the prior year period.

Reported diluted loss per share was $0.13 compared to $0.21 in the prior year period. Normalized diluted EPS was $0.16 compared with $0.18 in the prior year period.

Full year normalized EBITDA increased to $900 million compared with $782 million in the prior year period.

Full year operating cash flow was $496 million compared with $930 million in the prior year period.

The Company initiated its full year 2025 outlook for net sales to decline in the range of 4% to 2%, core sales in the range of a 2% decline to a 1% increase and a normalized EPS range of $0.70 to $0.76.

Fourth Quarter 2024 Operating Results

Net sales were $1.9 billion, a decline of 6.1% compared with the prior year period, reflecting a core sales decline of 3.0%, as well as the impact of unfavorable foreign exchange and business exits. Pricing in international markets to offset inflation and currency movements was a meaningful contributor to the Company's core sales performance.

Reported gross margin was 34.2% compared with 29.9% in the prior year period, as the positive impact from productivity savings and pricing more than offset the headwinds from lower sales volume, inflation and foreign exchange. Normalized gross margin was 34.6% compared with 31.1% in the prior year period, which represents the sixth consecutive quarter of year-over-year improvement.

Reported operating income was $9 million compared with operating loss of $10 million in the prior year period. Non-cash impairment charges of $87 million and $68 million were incurred in the current and prior year periods, respectively, primarily related to intangible assets. Reported operating margin was 0.5% compared with negative 0.5% in the prior year period, largely reflecting benefits from higher gross margin and higher savings from restructuring actions that were partially offset by higher advertising and promotions costs as well as incentive compensation costs. Normalized operating income was $139 million, or 7.1% of sales, compared with $133 million, or 6.4% of sales, in the prior year period.

Net interest expense was $72 million compared with $70 million in the prior year period.

Reported tax benefit was $25 million compared with $78 million in the prior year period. The normalized tax benefit was $4 million compared with $17 million in the prior year period.

Reported net loss was $54 million compared with $86 million in the prior year period. Normalized net income was $69 million compared with $73 million in the prior year period. Normalized EBITDA was $216 million compared with $219 million in the prior year period.

Reported diluted loss per share was $0.13 compared with $0.21 in the prior year period. Normalized diluted EPS was $0.16 compared with $0.18 in the prior year period.

An explanation of non-GAAP measures disclosed in this release and a reconciliation of these non-GAAP results to comparable GAAP measures, if available, are included in the tables attached to this release.

Balance Sheet and Cash Flow

Full year operating cash flow was $496 million compared with $930 million in the prior year period. The prior year operating cash flow included a significant contribution from working capital primarily due to inventory reduction.

During the fourth quarter of 2024, the Company refinanced $1.25 billion of debt. At the end of 2024, Newell Brands had debt outstanding of $4.6 billion and cash and cash equivalents of $198 million, respectively, compared with $4.9 billion and $332 million, respectively at the end of the prior year.

Fourth Quarter 2024 Operating Segment Results

The Learning & Development segment generated net sales of $628 million compared with $635 million in the prior year period, reflecting core sales growth of 0.4%, which more than offset the impact of unfavorable foreign exchange. Core sales increased in the Writing business and decreased in the Baby business. Reported operating income was $99 million, or 15.8% of sales, compared with $80 million, or 12.6% of sales, in the prior period. Normalized operating income was $101 million, or 16.1% of sales, compared with $88 million, or 13.9% of sales, in the prior year period.

The Home & Commercial Solutions segment generated net sales of $1.2 billion compared with $1.3 billion in the prior year period, reflecting a core sales decline of 4.6%, as well as the impact of unfavorable foreign exchange and certain business exits. Core sales increased in the Commercial business, primarily due to international pricing to offset inflation and currency movements, while core sales declined in the Kitchen and Home Fragrance businesses. Reported operating income was $28 million, or 2.4% of sales, compared with $31 million, or 2.4% of sales, in the prior year period. Normalized operating income was $137 million, or 11.7% of sales, compared with $137 million, or 10.7% of sales, in the prior year period.

The Outdoor & Recreation segment generated net sales of $152 million compared with $165 million in the prior year period, reflecting a core sales decline of 3.8%, as well as the impact of unfavorable foreign exchange. Reported operating loss was $34 million, or negative 22.4% of sales, compared with $45 million, or negative 27.3% of sales, in the prior year period. Normalized operating loss was $28 million, or negative 18.4% of sales, compared with $25 million, or negative 15.2% of sales, in the prior year period.

Full Year 2024 Operating Results

Net sales for the full year ended December 31, 2024 were $7.6 billion, a decline of 6.8% compared to the prior year, reflecting a core sales decrease of 3.4%, as well as the impact of certain category exits and unfavorable foreign exchange.

Reported gross margin was 33.6% compared with 28.9% in the prior year, as the positive impact from productivity savings and pricing more than offset the headwinds from lower sales volume, inflation and foreign exchange. Normalized gross margin was 34.1%, compared with 29.5% in the prior year.

Reported operating income was $67 million, or 0.9% of sales, compared with operating loss of $85 million, or negative 1.0% of sales, in the prior year. Non-cash impairment charges of $353 million and $342 million were incurred in the current and prior year, respectively. Normalized operating income was $618 million, or 8.2% of sales, compared with $499 million, or 6.1% of sales, in the prior year.

Net interest expense was $295 million compared with $283 million in the prior year.

Reported tax benefit was $44 million compared with $155 million in the prior year. The normalized tax provision was $21 million compared with a normalized tax benefit of $86 million in the prior year.

Reported net loss was $216 million compared with $388 million in the prior year. Normalized net income was $286 million compared with $277 million in the prior year. Normalized EBITDA was $900 million compared with $782 million in the prior year.

Reported diluted loss per share was $0.52 compared with $0.94 in the prior year. Normalized diluted EPS was $0.68 compared with $0.67 in the prior year.

Organizational Realignment Plan

In January 2024, the Company announced an organizational realignment, which is expected to strengthen the Company’s front-end commercial capabilities, such as consumer understanding and brand communication, in support of the Where to Play / How to Win choices the Company unveiled in June of 2023 (the "Realignment Plan"). As part of the organizational realignment, the Company made several organizational design changes, which entailed: standing up a cross-functional brand management organization, realigning business unit finance to fully support the new global brand management model, further simplifying and standardizing regional go-to-market organizations, and centralizing domestic retail sales teams, the digital technology team, business-aligned accounting personnel, the Manufacturing Quality team, and the Human Resources functions into the appropriate center-led teams to drive standardization, efficiency and scale with a One Newell approach. Under the Realignment Plan in 2024, the Company realized annualized pretax savings of $75 million, net of reinvestment, and incurred restructuring and related charges of $52 million.

Outlook

The Company initiated its preliminary outlook for first quarter and full year 2025 as follows:

|

Q1 2025 Outlook |

Full Year 2025 Outlook |

Net Sales |

8% to 5% decline |

4% to 2% decline |

Core Sales |

4% to 2% decline |

(2%) to +1% |

Normalized Operating Margin |

2.0% to 4.0% |

9.0% to 9.5% |

Normalized EPS |

($0.09) to ($0.06) |

$0.70 to $0.76 |

The Company initiated its outlook for full year 2025 operating cash flow of $450 million to $500 million.

The Company has presented forward-looking statements regarding core sales, normalized operating margin and normalized EPS. These non-GAAP financial measures are derived by excluding certain amounts, expenses or income, from the corresponding financial measures determined in accordance with GAAP. The determination of the amounts that are excluded from these non-GAAP financial measures is a matter of management judgement and depends upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period in reliance on the exception provided by item 10(e)(1)(i)(B) of Regulation S-K. We are unable to present a quantitative reconciliation of forward-looking normalized operating margin or normalized EPS to their most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict all of the necessary components of such GAAP measures without unreasonable effort or expense. In addition, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the Company's future financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between the Company's actual results and preliminary financial data set forth above may be material.

Conference Call

Newell Brands’ fourth quarter and full year 2024 earnings conference call will be held today, February 7, at 9:00 a.m. ET. A link to the webcast is provided under Events & Presentations in the Investors section of the Company’s website at www.newellbrands.com. A webcast replay will be made available in the Quarterly Earnings section of the Company’s website.

Non-GAAP Financial Measures

This release and the accompanying remarks contain non-GAAP financial measures within the meaning of Regulation G promulgated by the U.S. Securities and Exchange Commission (the "SEC") and includes a reconciliation of non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP.

The Company uses certain non-GAAP financial measures that are included in this press release, the additional financial information and accompanying remarks both to explain its results to stockholders and the investment community and in the internal evaluation and management of its businesses. The Company’s management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures (a) permit investors to view the Company’s performance and liquidity using the same tools that management uses to evaluate the Company’s past performance, reportable segments, prospects for future performance and liquidity, and (b) determine certain elements of management incentive compensation.

The Company’s management believes that core sales provides a more complete understanding of underlying sales trends by providing sales on a consistent basis as it excludes the impacts of acquisitions, divestitures, retail store openings and closings, certain market and category exits, and changes in foreign exchange from year-over-year comparisons. The effect of changes in foreign exchange on reported sales is calculated by applying the prior year average monthly exchange rates to the current year local currency sales amounts (excluding acquisitions and divestitures), with the difference between the current year reported sales and constant currency sales presented as the foreign exchange impact increase or decrease in core sales. The Company’s management believes that “normalized” gross margin, “normalized” operating income, “normalized” operating margin, "normalized EBITDA", “normalized” net income, “normalized” diluted earnings per share, “normalized” interest and “normalized” income tax benefit or expense, which exclude restructuring and restructuring-related expenses and one-time and other events such as costs related to the extinguishment of debt; certain tax benefits and charges; impairment charges; pension settlement charges; divestiture costs; costs related to the acquisition, integration and financing of acquired businesses; amortization of acquisition-related intangible assets; inflationary adjustments; and certain other items, are useful because they provide investors with a meaningful perspective on the current underlying performance of the Company’s core ongoing operations and liquidity. “Normalized EBITDA” is an ongoing liquidity measure (that excludes non-cash items) and is calculated as normalized earnings before interest, tax, depreciation, amortization and stock-based compensation expense.

Commencing in the third quarter of 2024, the Company changed its normalization practice. Historically, the Company has excluded from normalized results inventory write-downs and accelerated depreciation charges relating to restructuring and exit activities that were reflected within its restructuring-related costs non-GAAP adjustment. Beginning in the third quarter of 2024, the Company no longer excludes these charges from its normalized results. The Company has also ceased to exclude from normalized results prior period adjustments related to a bad debt reserve and subsequent recovery with respect to the bankruptcy of an international customer. The Company’s outlook for the first quarter and twelve months ending December 31, 2025 reflect these changes, and we have recast prior periods presented in this release to conform to current period presentation. The Company will continue to provide normalized measures which exclude the impact of restructuring costs and restructuring-related costs (other than inventory write-downs and accelerated depreciation), acquisition-related amortization expense and impairment charges, pension settlement losses and other items. Additional prior periods have been recast as presented in Exhibit 99.2 to the Company’s current report on Form 8-K dated October 25, 2024.

The Company uses a "with" and "without" approach to calculate normalized income tax expense or benefit. At an interim period, the Company determines the year to date tax effect of the pretax items excluded from normalized results by allocating the difference between the calculated GAAP and calculated normalized tax expense or benefit.

The Company defines "net debt" as short-term debt, current portion of long-term debt and long-term debt less cash and cash equivalents.

While the Company believes these non-GAAP financial measures are useful in evaluating the Company’s performance and liquidity, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

About Newell Brands

Newell Brands (NASDAQ: NWL) is a leading global consumer goods company with a strong portfolio of well-known brands, including Rubbermaid, Sharpie, Graco, Coleman, Rubbermaid Commercial Products, Yankee Candle, Paper Mate, FoodSaver, Dymo, EXPO, Elmer’s, Oster, NUK, Spontex and Campingaz. Newell Brands is focused on delighting consumers by lighting up everyday moments.

This press release and additional information about Newell Brands are available on the Company’s website, www.newellbrands.com.

Forward-Looking Statements

Some of the statements in this press release and its exhibits, particularly those anticipating future financial performance, business prospects, growth, operating strategies, the benefits and savings associated with the Realignment Plan, future macroeconomic conditions and similar matters, are forward-looking statements within the meaning of the federal securities laws. These statements generally can be identified by the use of words or phrases, including, but not limited to, "guidance," "outlook," “intend,” “anticipate,” “believe,” “estimate,” “project,” “target,” “plan,” “expect,” “setting up,” "beginning to,” “will,” “should,” “would,” "could," “resume,” “remain confident,” "remain optimistic," "seek to," or similar statements. We caution that forward-looking statements are not guarantees because there are inherent difficulties in predicting future results. Actual results may differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to:

the Company’s ability to optimize costs and cash flow and mitigate the impact of soft global demand and retailer inventory rebalancing through discretionary and overhead spend management, advertising and promotion expense optimization, demand forecast and supply plan adjustments and actions to improve working capital;

the Company’s dependence on the strength of retail and consumer demand and commercial and industrial sectors of the economy in various countries around the world;

the Company’s ability to improve productivity, reduce complexity and streamline operations;

risks related to the Company’s substantial indebtedness, potential increases in interest rates or changes in the Company’s credit ratings including the failure to maintain financial covenants which if breached could subject us to cross-default and acceleration provisions in our debt documents;

competition with other manufacturers and distributors of consumer products;

major retailers’ strong bargaining power and consolidation of the Company’s customers;

supply chain and operational disruptions in the markets in which we operate, including as a result of geopolitical and macroeconomic conditions and any global military conflicts including those between Russia and Ukraine and in the Middle East;

changes in the prices and availability of labor, transportation, raw materials and sourced products, including significant inflation, and the Company’s ability to offset cost increases through pricing and productivity in a timely manner;

the Company's ability to effectively execute its turnaround plan, including the Realignment Plan and other restructuring initiatives;

the Company’s ability to develop innovative new products, to develop, maintain and strengthen end-user brands and to realize the benefits of increased advertising and promotion spend;

the risks inherent to the Company’s foreign operations, including currency fluctuations, exchange controls and pricing restrictions;

future events that could adversely affect the value of the Company’s assets and/or stock price and require additional impairment charges;

unexpected costs or expenses associated with dispositions;

the cost and outcomes of governmental investigations, inspections, lawsuits, legislative requests or other actions by third parties, the potential outcomes of which could exceed policy limits, to the extent insured;

the Company’s ability to remediate the material weaknesses in internal control over financial reporting and to maintain effective internal control over financial reporting;

risk associated with the use of artificial intelligence in the Company’s operations and the Company’s ability to properly manage such use;

a failure or breach of one of the Company’s key information technology systems, networks, processes or related controls or those of the Company’s service providers;

the impact of United States and foreign regulations on the Company’s operations, including the impact of tariffs and environmental remediation costs and legislation and regulatory actions related to product safety, data privacy and climate change;

the potential inability to attract, retain and motivate key employees;

changes in tax laws and the resolution of tax contingencies resulting in additional tax liabilities;

product liability, product recalls or related regulatory actions;

the Company’s ability to protect its intellectual property rights;

the impact of climate change and the increased focus of governmental and non-governmental organizations and customers on sustainability issues, as well as external expectations related to environmental, social and governance considerations;

significant increases in the funding obligations related to the Company’s pension plans; and

other factors listed from time to time in our SEC filings, including but not limited to our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other filings.

The consolidated condensed financial statements are prepared in conformity with accounting principles generally accepted in the United States (“U.S. GAAP”). Management’s application of U.S. GAAP requires the pervasive use of estimates and assumptions in preparing the condensed consolidated financial statements. The company continues to be impacted by inflationary pressures, soft global demand, major retailers' focus on tight control over inventory levels, elevated interest rates and indirect macroeconomic impacts from geopolitical conflicts, which has required greater use of estimates and assumptions in the preparation of our condensed consolidated financial statements. Although we believe we have made our best estimates based upon current information, actual results could differ materially and may require future changes to such estimates and assumptions, including reserves, which may result in future expense or impairment charges.

The information contained in this press release and the tables is as of the date indicated. The Company assumes no obligation to update any forward-looking statements as a result of new information, future events or developments. In addition, there can be no assurance that the Company has correctly identified and assessed all of the factors affecting the Company or that the publicly available and other information the Company receives with respect to these factors is complete or correct.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250207930734/en/

Investor Contact:

Joanne Freiberger

SVP, Investor Relations & Chief Communications Officer

+1 (727) 947-0891

joanne.freiberger@newellco.com

Media Contact:

Danielle Clark

Senior Manager, Corporate Communications

+1 (404) 783-0419

danielle.clark@newellco.com